Pricing

Despite the unprecedented global disruption precipitated by the COVID-19 pandemic, 2020 and H1 2021 saw a revival in market sentiment for lithium with allied rebound in demand and prices.

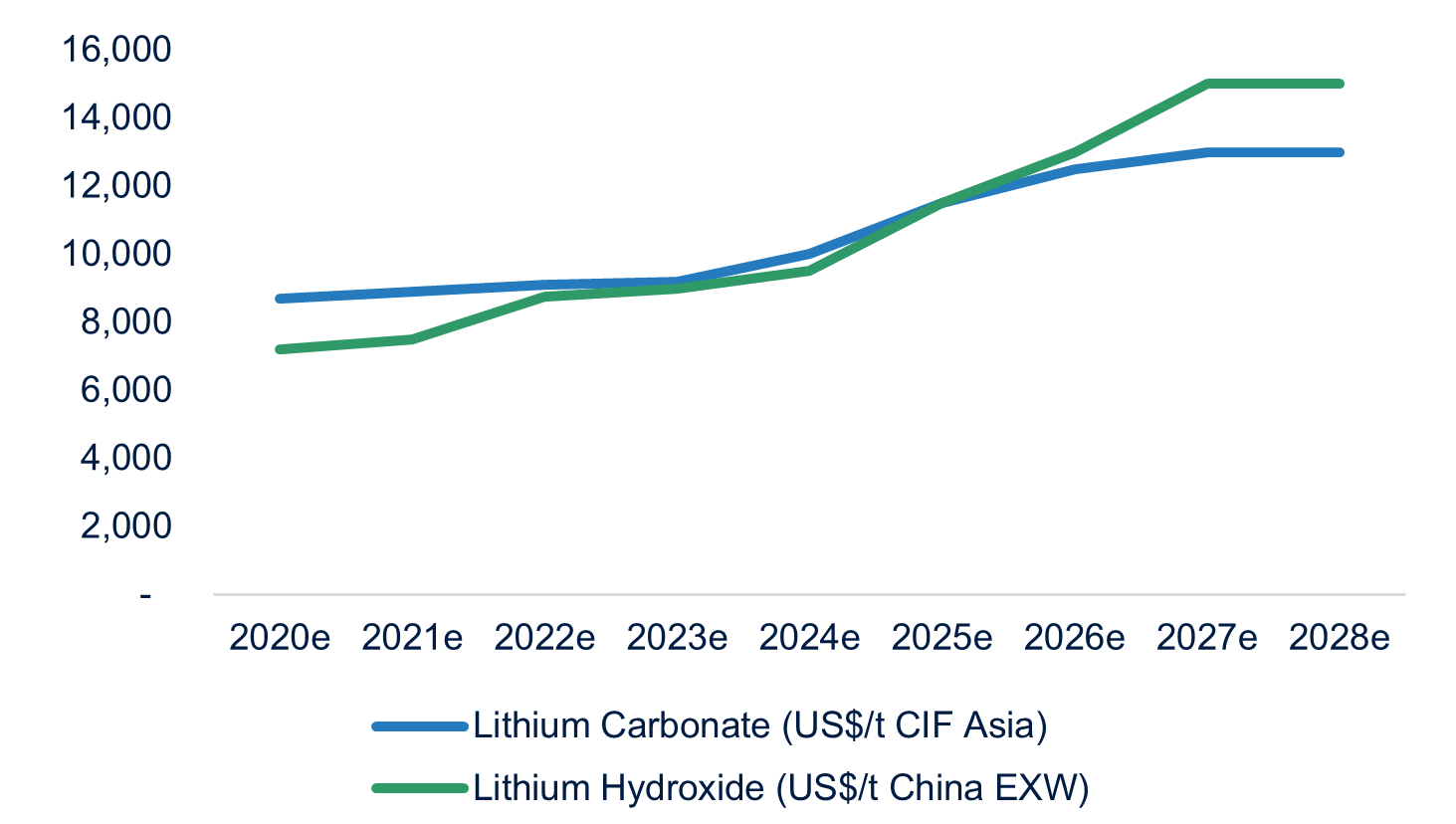

In H1 2021, lithium product prices continued their upward trajectory, by June 2021 prices continued to be strong with lithium carbonate and lithium hydroxide both at US$13,500 and US$15,000 per tonne respectively[1]. This trend has continued into Q3 2021, with Fastmarkets reporting prices of US$14,000 and US$15,500 per tonne respectively in July 2021[2].

Supply / Demand

This buoyancy of the lithium price has been driven by the market tightening as the electric vehicle revolution accelerates. Demand has eroded the oversupply seen in 2019 and 2020. This tightness in the market is expected to continue, with Credit Suisse saying that lithium demand might treble by 2025 from 2020 levels and that supply would be stretched to meet that demand, with higher prices needed to incentivise the required supply response[3].

World demand for lithium is forecast to increase from 305,000 tonnes lithium carbonate equivalent (“LCE”) in 2020 to 452,000 tonnes in 2021 (48% increase YOY)[4]. This is primarily driven by sales of EVs which increased by 126% YOY for Q1 2021, which is skewed due to low sales in Q1 2020 attributable to the pandemic. However global EV sales are expected to exceed 4.6 million in 2021 vs 3.2 million units in 2020, which would be a 44% increase for the year, which is comparable to the 43% increase from 2019 to 2020[5]. The consequence of this dramatic change in consumer behaviour is that in 2023, demand for lithium is forecast to increase at a CAGR of 30% to 675,000 tonnes LCE from 2020 levels. By 2030, global battery demand is expected to increase 14-fold by 2030[6] with Statista estimating lithium demand of 1.8 million tonnes by 2030[7].

In contrast to the impressive demand fundamentals, the lithium production is only anticipated to be 441,000 tonnes LCE in 2021, down from 464,000 tonnes in 2020. However, lithium production is expected to grow at a CAGR of 13.4% to 679,000 in 2023. Macquarie said this year’s deficit would be 2,900 tonnes of LCE, rising to 20,200 tonnes in 2022 and then up 61,000 tonnes in 2023[8]. It is at this point that lithium stocks are expected to be exhausted and persistent undersupply to be entrenched.